E-money, short for Electronic Money, is the electronic alternative to cash. Since it started as a concept in the 1980s and rose to prominence during the Dot-Com era, it has acted as one of the biggest game-changers in the financial industry. In a matter of only four years, from 2014 to 2018, the number of electronic money transactions in Europe alone doubled to more than 4 billion.

This aspiring form of money deserves our attention. To provide a starting point, this article will give an overview of:

The definition of e-money as a whole

The subtle distinctions in its applications

The process of electronic payment with e-money

The potential downsides of e-money

And finally, e-money licencing and who should apply for such a license

The Definition of the EMD

In the EU, all handling of fiat-backed electronic money – from payment to obtaining an e-money license to supervising e-money institutions – falls under the purview of the EMD (Electronic Money Directive). This directive was put in place by the European Commission to create a cohesive rulebook for electronic money, including practices for security, risk-aversion, licensing and onboarding of new companies willing to position themselves on the electronic money market.

In 2009, the Commission brought a revised version of this directive into force, now referred to as the EMD2. It contains the following definition of e-money:

“electronically, including magnetically, stored monetary value as represented by a claim on the issuer which is issued on receipt of funds for the purpose of making payment transactions […], and which is accepted by a natural or legal person other than the electronic money issuer“

European Central Bank 2020, Electronic Money, accessed 23 October 2020,

Let’s look at it in more detail.

E-money, following this definition, is a stored value which generates a claim once it is issued. So, like all money in our centralized financial system, electronic money maintains its value through trust. In the case of e-money, this trust is backed by stable, well-accepted assets. The issuer only gives out e-money “on the receipt of funds”. This means that all electronic money in circulation derives from fiat money. This makes it more likely for said “natural and legal persons” to accept e-money payments.

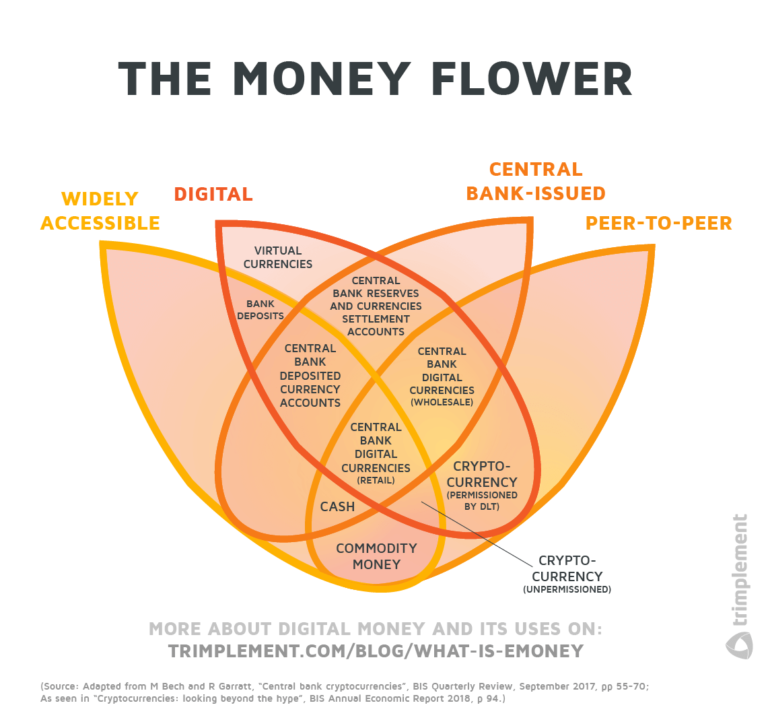

The Difference Between Electronic Money and Other Digital Currencies

Electronic money, as represented by the digital values stored and transferred online, is an e-currency. Yet, those two terms cannot be used synonymously. The label e-currency also applies to cryptocurrencies, specific tokens like ICOs or virtual currencies like video game monetization currencies. All these unique variations of digital currency have qualities and applications that differentiate them from e-money.

Cryptocurrencies vs. E-Money

Take cryptocurrencies, for example. Like electronic money, they have a worth which can change with the ebb and flow of the market. There are also goods and service providers who accept them as payment.

But that’s where the similarities end. In opposition to electronic money, cryptocurrencies are not governed by a centralized authority. In “classic” electronic money transactions you have a financial institution acting as an intermediary supervising it. E-money institutions must comply with anti-money laundering, anti-fraud and know-your-customer regulations or face legal consequences. Cryptocurrencies, as a relatively new technology, are not yet widely regulated. A decentralized complex peer system validates and processes crypto transactions.

Furthermore, classic cryptocurrencies are not backed by fiat money. Thus in contrast to e-money, whose fluctuation in value is tied to the assigned fiat currency’s value. Cryptocurrency’s worth is fluctuating, as determined by supply, demand and developments of the crypto market.

Stablecoins vs. E-Money

A relatively new form of cryptocurrency – Stablecoins – throws a bridge to electronic money. A stablecoin’s value is indeed backed by one or multiple assets, some of which can be fiat currencies. Those stablecoins combine the solidity of fiat-mirroring e-money with the decentralized distribution of cryptocurrencies.

Virtual Currencies vs. E-Money

Strictly speaking, virtual currencies are more stable in worth than many cryptocurrencies. Private companies play the role of issuers here instead of governments. One example of this type of currency is the tokens used as in-game currencies in video game monetization. They have a specific value and players can only spend them on content within the game’s environment. But while such virtual currencies cost money (and for popular games have been the subject of speculation in the past), they are not e-money.

Again, a look at the European Commission’s definition will lighten up the matter. The regulation states that virtual currencies are:

“a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community”

European Central Bank 2012, “Virtual Currency Schemes October 2012”, p. 2, accessed 23 October 2020

We might want to add an “only” to the end of that sentence. Virtual currencies are not backed by fiat money and not held to the same regulatory standards. They can only act as a means of payment within a specific environment, like a game or an online shop. As long as one cannot exchange these virtual currencies back to fiat currency, they don’t fall under e-money regulations (see the redemption criterion below). Overall, virtual currencies and electronic money have many shared characteristics, yet the former are much more restricted in their use. This is why companies dealing in them don’t need an e-money license.